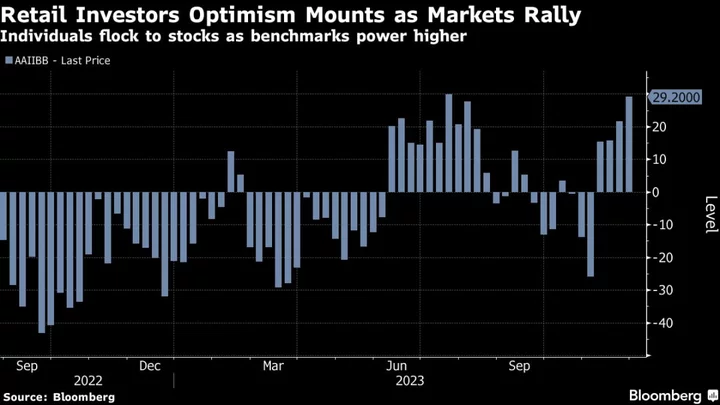

Asian equity futures were mixed after the Federal Reserve hiked interest rates to a 22-year high and indicated that further tightening would be “data dependent.”

Contracts for Japan fell slightly, those for Australia were little changed and Hong Kong futures rose, along with an index of US-listed Chinese stocks. There was something for both bulls and bears in Fed Chair Jerome Powell’s remarks, but the market finished the US session betting the central bank’s next move would possibly be a skip.

Two-year US yields dropped alongside the dollar. The yen steadied Thursday after a 0.5% gain as traders await the Bank of Japan’s policy decision on Friday and any hint of a shift in its yield-curve control policy. In the US, stocks rebounded from session lows, with the Dow Jones Industrial Average notching its 13th straight advance — the longest winning run since 1987.

In late trading, Facebook parent Meta Platforms Inc. climbed after projecting revenue that beat estimates while EBay Inc. fell on a disappointing profit outlook. Investors in Asia will have earnings from Samsung Electronics Co. on their radars, along with industrial profits figures from China.

Swaps referencing future Fed decisions priced in slightly lower odds of another increase this year, which ebbed to 47%. With Fed officials fine-tuning their effort to further quell inflation, Powell said it was still “certainly possible” they hike again in September.

“With the Fed’s data dependent message and risks of a yield-curve control adjustment by the BOJ, we should see some moderate downward pressure on dollar-yen going into the BOJ meeting,” said Vassili Serebriakov, an FX and macro strategist at UBS in New York.

Kristina Clifton, a senior economist and strategist at Commonwealth Bank of Australia, cautioned that dollar-yen could be volatile over the next few days.

More Comments:

Chamath de Silva, senior portfolio manager at BetaShares Holdings:

“The decision didn’t deliver a whole lot of answers, and despite a bit of chop around the Q&A, US equities didn’t have a whole lot to work with, so neither will Asia. I’m not expecting major moves on the back of it.”

Rajeev Sharma, managing director of fixed income at Key Private Bank:

“In our opinion, the rate hiking cycle is done and the Fed will now pause for the rest of the year. The latest market reaction also supports this thesis with yields dipping slightly across the front end of the yield curve.”

Frances Donald, global chief economist at Manulife Investment Management:

“We now believe that the Fed is on a prolonged ‘hawkish hold’. In our base case, their next move will likely be a cut but it will take until 2024 until we see it. That said, Powell will have no choice but to keep the threat of hikes alive, lest he encourage markets to prematurely price in cuts and reignite inflation expectations.”

Chris Zaccarelli, chief investment officer for Independent Advisor Alliance:

“Bears can point to Powell’s insistence that all meetings are live and that core inflation is ‘pretty elevated,’ and bulls can point to Powell’s insistence that they could easily skip the next meeting and keep rates unchanged in September.”

Another driver of trading Wednesday was the large batch of earnings reports, with results from big tech being highly scrutinized after the shares notched a historic advance in the first six months of the year.

“Big tech earnings have been very Darwinian, and investors are only rewarding the companies that truly post strong results,” David Bahnsen, chief investment officer at the Bahnsen Group. “After extreme gains so far this year in big tech stocks, we have now moved to a phase where each company’s stock price is very non-correlated to one another.”

Key events this week:

- China industrial profits, Thursday

- ECB rate decision, Thursday

- US GDP, durable goods orders, initial jobless claims, wholesale inventories, Thursday

- Japan Tokyo CPI, Friday

- BOJ rate decision, Friday

- Eurozone economic confidence, consumer confidence, Friday

- US consumer income, employment cost index, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:19 a.m. Tokyo time. The S&P 500 was little changed

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.4%

- Nikkei 225 futures fell 0.3%

- Australia’s S&P/ASX 200 Index futures were little changed

- Hang Seng Index futures rose 0.9%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1084

- The Japanese yen fell 0.1% to 140.43 per dollar

- The offshore yuan was little changed at 7.1493 per dollar

- The Australian dollar was unchanged at $0.6758

Cryptocurrencies

- Bitcoin fell 0.5% to $29,442.63

- Ether fell 0.4% to $1,874.19

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.87%

- Australia’s 10-year yield declined two basis points to 3.99%

Commodities

- West Texas Intermediate crude rose 0.2% to $78.97 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth, Georgina McKay and Matthew Burgess.