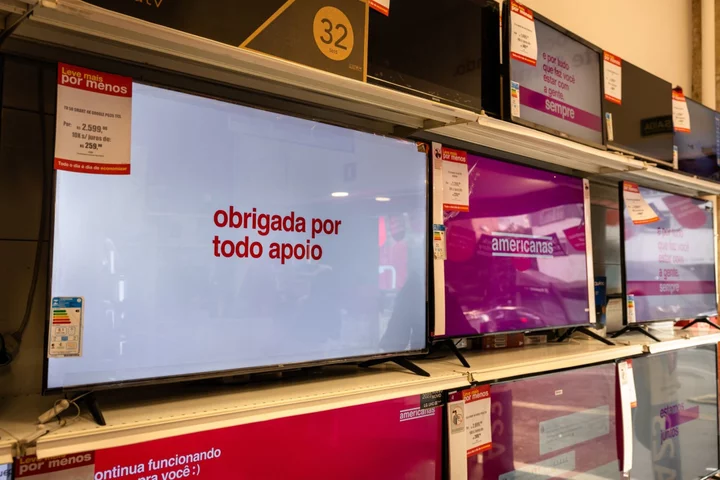

Brazilian retailer Americanas SA reached an agreement with bank creditors to overhaul some of its debt, in a key step toward eventually exiting bankruptcy protection.

Some 11 months after sinking into a crisis due to an accounting fraud that more than doubled its debt to 42.5 billion reais ($8.7 billion), a binding agreement was signed with creditors holding more than 35% of company’s debt, excluding intercompany credits, Americanas said in a filing Monday. Other creditors also showed interest in participating on the same deal in a non-binding way, the company said.

The agreement, which will allow Americanas to present a new plan in court, is the result of “extensive” negotiations with creditors who hold more than 50% of the company’s debt combined, the retailer said. It added that the parts committed to backing the plan in an upcoming meeting, scheduled for Dec. 19.

Although Americanas doesn’t name creditors in the filing, banks have the majority of the debt. Their buy-in was seen as key to avoid any risk of liquidation for the company, which has seen digital sales sink while losing millions of clients and shuttering dozens of stores in the past year.

The debt restructuring proposal includes a cash injection and so-called DIP financing of 12 billion reais by the top shareholders, and a debt-to-equity swap from creditors of as much as 12 billion reais. That could boost the company’s capital by up to 24 billion reais ($4.9 billion.)

All shareholders will be allowed to participate in the capital increase. Americanas will seek approval from the board of directors to grant one subscription bonus to every three shares issued as an additional benefit, it said.

The company also secured a 1.5 billion-real bank or judicial insurance guarantee, available for two years from the conclusion of the restructuring stages or until the end of the judicial reorganization, whichever comes first.

The plan also allocated as much as 8.7 billion for the payment of financial creditors, through a reverse auction or early payment of credits at a discount. The company expects to have 1.875 billion reais in gross debt after implementing the measures set out in the plan.

The deal comes after the retailer published new earnings reports for 2021 and 2022 that showed it lost nearly 20 billion reais in the period. The estimated size of the accounting fraud was 25 billion reais, bigger than what it had initially estimated.

The crisis at Americanas has been a headache for the billionaire trio Jorge Paulo Lemann, Carlos Sicupira and Marcel Telles, who own about 30% of the company — though the hit to their reputation as the savviest businessmen in the country outweighed the overall financial impact. The blow up also contributed to a credit crunch for Brazilian companies, and put more pressure on retailers already reeling from high interest rates.

Americanas, founded in 1929, is one of Brazil’s most iconic retailers and is known for its affordable prices for everything from kitchen appliances to clothes, candy and toys.

The crisis engulfed the firm on Jan. 11 after a new chief executive officer hired from outside the company took over. Previously, the same CEO had run the management team for decades.

The incoming CEO Sergio Rial, who has a long resume at firms like Banco Santander SA, BRF SA and Cargill Inc., resigned just nine days into the job alleging “accounting inconsistencies” estimated at 20 billion reais. The board moved immediately to hire new leaders and sideline the remaining executives from the previous management team, while also fending off creditors and trying to keep operations from collapsing.

Blame game

The new team has accused the previous group led by Miguel Gutierrez of hiding debts and inflating profits by falsifying advertising contracts and obscuring supply-chain financing transactions. Gutierrez, who has relocated to Spain where he has nationality, called himself a scapegoat in one of the only comments he’s made through lawyers.

Americanas, now led by CEO Leonardo Coelho and CFO Camille Loyo Faria, has said it expects to reduce debt to as low as 1 billion reais in 2025 and post positive earnings before interest, taxes, depreciation and amortization of close to 2 billion reais.

(Updates with details starting in headline)