Abu Dhabi National Oil Co. indicated it’s prepared to boost its informal offer for Covestro AG to about €11.6 billion ($12.7 billion) on the condition the German chemicals group agrees to enter formal talks, people with knowledge of the matter said.

The state-backed energy giant has verbally signaled to Covestro that it could come back with a new, written proposal of €60 per share, should such a bump get negotiations started, the people said. An offer at that level would represent a premium of about 29% to Covestro’s closing share price on Friday.

Covestro’s management and supervisory board are considering their options and may respond as soon as this week, the people said.

Any such move by Adnoc would improve previous informal bids of €55 and €57 per share. The most recent of these, submitted in July, is still seen as too low by Covestro, according to the people. Both companies and their advisers have continued to discuss the merits of a transaction, they said.

As well as price, Adnoc has been trying to address other Covestro concerns about a transaction, including how it would help the German company’s management develop the specialty chemical operations, Bloomberg News reported previously.

Deliberations are ongoing and Adnoc has made no final decision about if, or by how much, to increase an offer for Covestro, the people said, asking not to be identified discussing confidential information. Representatives for Adnoc and Covestro declined to comment.

Deal Hunt

Adnoc’s Chief Executive Officer Sultan Al Jaber is hunting for deals to better compete with Saudi Aramco’s Sabic chemical unit, and to develop the company’s own downstream and renewable energy operations. Adnoc is in separate talks with Austria’s OMV AG about a potential merger of two companies they back, Borouge Plc and Borealis AG, to form a chemicals and plastics giant worth more than $30 billion.

The potential transactions dovetail with a wider plan by the United Arab Emirates to attract investment and technology, as well as build new industries and manufacturing capabilities. Separately, Adnoc has started delivering liquefied natural gas to Germany, stepping in to help the country wean itself off of Russian supplies.

Still, Covestro’s Chief Executive Officer Markus Steilemann recently expressed some concern about the trend of more assets being bought or financed by entities backed by autocratic states. “You just have to think about what it means for the entire western world if this trend continues unabated and conflicts break out,” he said in an interview with German business newspaper Handelsblatt this month.

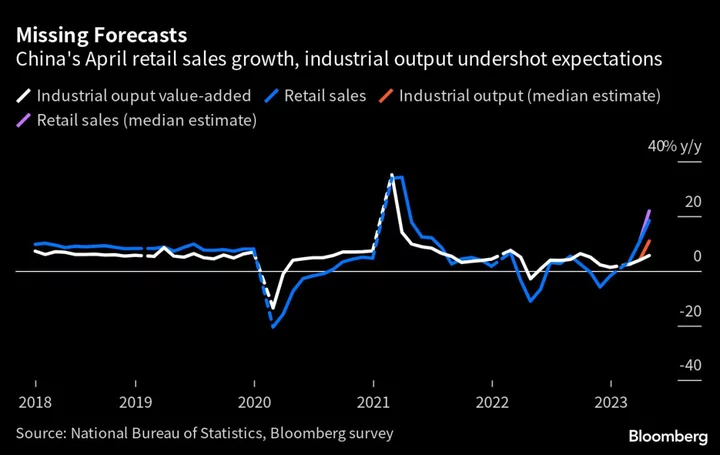

Covestro said earlier in August that it expected full year-profit to come in at the lower half of a guided range of €1.1 billion and €1.6 billion, citing waning global demand. Fellow German chemicals firms BASF SE, Evonik Industries AG and Lanxess AG have all warned of a worsening outlook for the rest of the year, blaming subdued global industrial output and slow demand for consumer products.

Author: Eyk Henning, Crystal Tse and Dinesh Nair