One of China’s best-performing bond fund managers boosted holdings of local government financing vehicles after a key economic policy meeting last month fueled optimism in the debt-laden sector.

“We took a heavy position in LGFV bonds after the Politburo meeting,” said Zhang Yi, investment director of the asset management department at Guolian Securities Co., referring to the gathering in July of the Communist Party’s 24-member top decision-making body. She said there were positive policy signals from the meeting, with a pro-growth tone regarding support for local government debt and the property sector.

Combined two-year performance of the public fixed income funds under her command ranks in the top 7% of their category, according to local fund-data provider Shanghai Tiantian Fund Distribution Co.

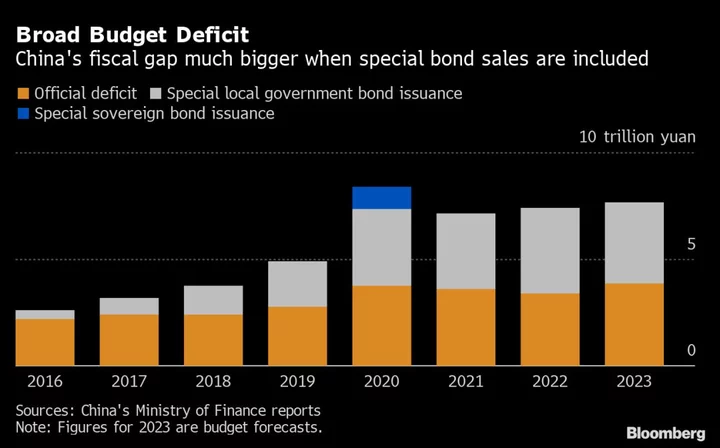

Zhang’s investment call comes at a time when there have been growing concerns about the $9 trillion debt market for LGFVs, which were created to finance projects like roads, airports and power infrastructure. Investors across Asia earmarked China’s ballooning levels of municipal borrowing as the region’s number one financial risk in a recent survey. The entities rarely generate enough returns to cover their obligations, and many local authorities are facing cash-flow problems due to the country’s years-long real estate crisis.

Bloomberg News reported Friday that China will allow provincial-level governments to raise about 1 trillion yuan ($139 billion) via bond sales to repay debt of LGFVs and other off-balance sheet issuers, a step toward addressing one of the biggest threats to the nation’s economy and financial stability.

Zhang has specialized in Chinese bond investments for nearly two decades, including three years as a manager for the nation’s Social Security Fund.

Each fixed-income fund at Guolian Securities’ asset management arm recently increased their LGFV positions by 20% to 40%, she said. The division had more than 100 billion yuan of entrusted funds at the end of 2022.

“Until there is a default on LGFV’s public debt, we will maintain a high-position portfolio in LGFV bonds,” according to Zhang. It’s difficult to imagine that LGFVs are in trouble on a large scale, she said, adding that sector bonds are currently cost-effective because of their yield and most being safe from default.

The LGFV market has posted gains this year despite the pockets of worries. Spreads have narrowed for medium-term yuan bonds versus government bond yields, Bloomberg-compiled data show. LGFV dollar notes have returned 4.66% for 2023, according to an iBoxx gauge.

For selecting LGFV bonds, Zhang’s strategy entails conducting in-depth research on a provincial basis and then choosing a few locales to prioritize investments. She focuses on whether a provincial government can clearly know the debt situation of its governing counties — including maturity size, fundraising methods and the effectiveness and execution of provincial debt-resolution plans.

“Most of the ones we bought have AA+ ratings, which have already avoided most of the tail risks,” Zhang said.

While no LGFV has missed payment on a public bond, repayment risks recently came under renewed scrutiny after China’s state pension fund advised asset managers handling its money to sell notes including those issued by riskier LGFVs. There have been cases of last-minute bond repayments while LGFV commercial-paper delinquencies have been on the rise as China’s economy slows.